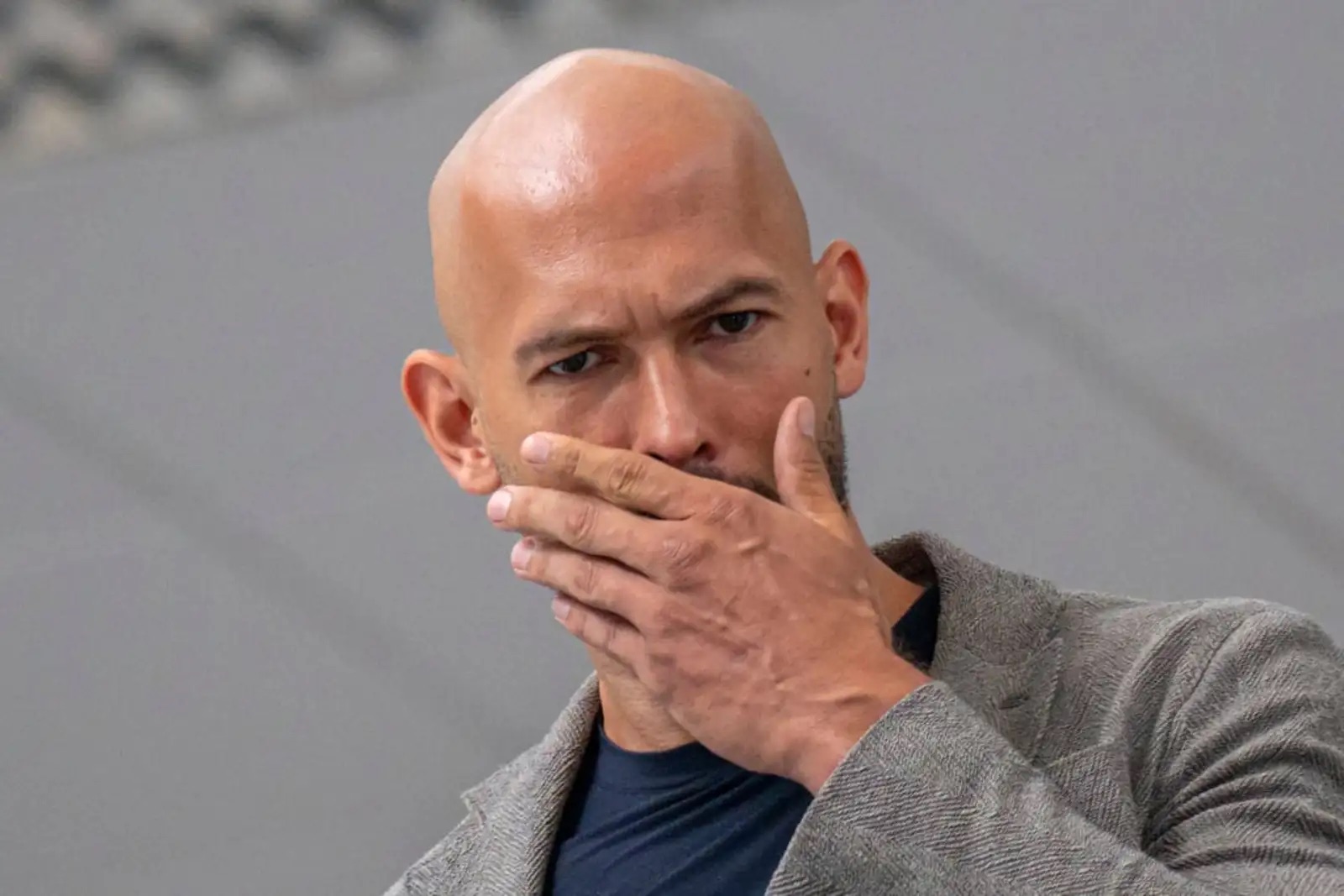

Most memecoins promoted by controversial social media influencer Andrew Tate have plummeted in value, losing 99% following his endorsement. Tate, who became famous on various social platforms, ventured into the world of Solana memecoins on June 7, backing over ten tokens known for their lack of intrinsic value.

According to a report by Bubblemaps dated October 19, shortly after Tate’s endorsement, these tokens experienced a drastic decline. The report highlighted the Germany Token ($GER), noting, “Andrew Tate first bought $GER […] A cluster held 30% of the supply, and the price dropped 99% in two months.” This pattern of sharp devaluation was not isolated, as most of the Tate-endorsed tokens followed a similar trajectory.

High Volatility and Insider Trading Concerns

Despite their known volatility, some traders have managed to capitalize on the price fluctuations of memecoins. For instance, on October 20, a crypto trader reported a 3,000-fold return on investment within three days on the Solana-based Nomogram (GNON) token, netting over $9 million in profit. However, the overall trend for these tokens has been overwhelmingly negative, raising concerns about potential insider trading and market manipulation.

Tate is not the only celebrity to have dabbled in cryptocurrency endorsements. Figures such as 50 Cent, Caitlyn Jenner, and Iggy Azalea have also promoted various Solana-based tokens, many of which have subsequently suffered significant losses. Coffeezilla, a popular YouTube investigator, detailed the crash of the Roost (ROOST) token, which plummeted over 90% shortly after Tate’s promotional efforts. The video also highlighted a security breach involving Roost’s treasury wallet, leading to further losses for the community.

Tate’s Social Media Statements

Adding to the controversy, Tate posted on X after the Coffeezilla report, claiming he could manipulate cryptocurrency prices at will: “Having the power to randomly pump any coin on the chart is super fun.” This statement has added fuel to the ongoing speculation about his role in the price volatility of the cryptocurrencies he has endorsed.

The phenomenon of celebrity-backed cryptocurrencies extends beyond Tate. Over 30 tokens launched in June on the Solana platform have seen their prices collapse, with most shedding 99% of their value within just a month of their launch, as reported by cryptocurrency analyst Slorg. This trend undermines mainstream trust in the crypto space, illustrating the risks associated with celebrity endorsements in this volatile market.

Insider Trading Allegations and Regulatory Scrutiny

The pattern of celebrity-endorsed tokens plummeting in value has not only led to financial losses for investors but also attracted attention regarding regulatory compliance and ethical trading practices. UFC contender Khamzat Chimaev’s Smash (SMASH) token, for instance, faced insider allegations with up to 78% of the token’s supply being held by team and developer-related wallets, which has raised questions about the fairness and transparency of these ventures.

The sharp decline in value of memecoins endorsed by Andrew Tate and other celebrities highlights the precarious nature of investing in highly speculative digital assets. While some individuals have profited, the vast majority of investors have faced substantial losses, leading to a reevaluation of the role of celebrity endorsements in cryptocurrency investments. As the market continues to mature, these incidents serve as a cautionary tale about the potential pitfalls of meme-based cryptocurrencies and the need for more stringent oversight.