The Securities and Exchange Commission (SEC) Chair, Gary Gensler, has indicated that the process of launching the first spot Ether exchange-traded funds (ETFs) in the United States is proceeding without any major issues. This development is keenly watched by investors eager for more mainstream investment avenues into cryptocurrencies.

Statements at Bloomberg Conference

During a Bloomberg conference on June 25, Gensler shared insights into the ongoing ETF approval process but refrained from committing to a specific launch timeline. He emphasized the importance of thorough disclosure by asset managers to ensure the registration statements could go effective, underscoring the SEC’s commitment to investor protection through clear disclosures.

- 19b-4 Filings: The SEC acknowledged receipt of 19b-4 filings from eight ETF applicants on May 23, setting the stage for the next steps in the regulatory process.

- Final Form S-1s: Asset managers are currently fine-tuning their Form S-1s, necessary for the SEC’s final approval before the ETFs can commence trading.

- Analyst Predictions: Some industry analysts speculate that the SEC could greenlight the ETFs as early as the first week of July, although official confirmation is pending.

The conversation around cryptocurrencies and ETFs has also intersected with political discourse:

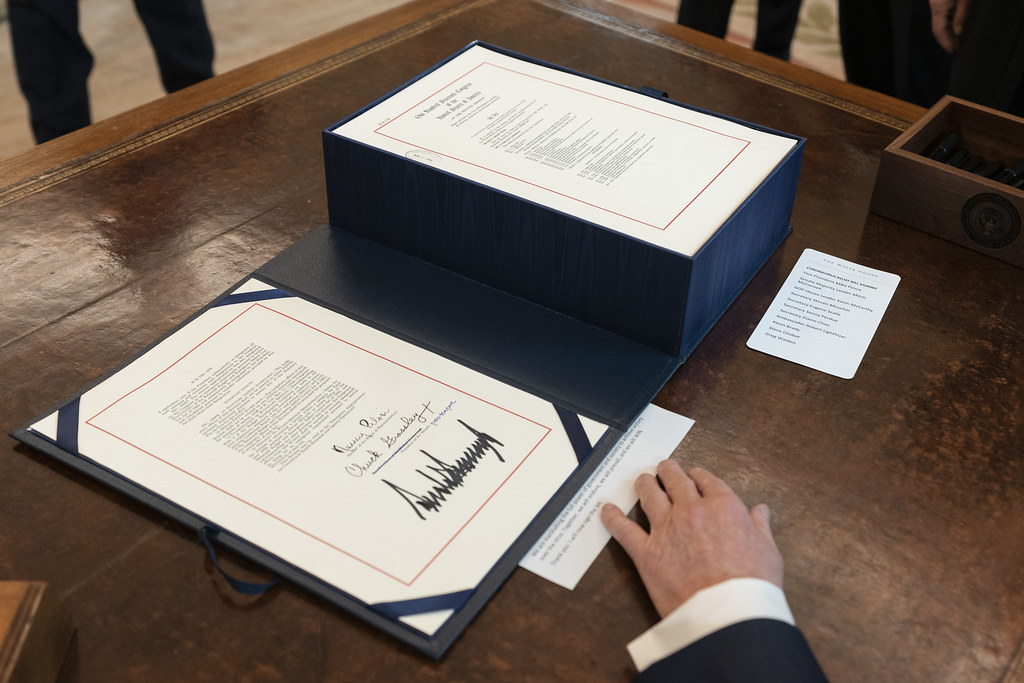

- Election Concerns: Presidential candidate Donald Trump has criticized the current administration’s approach to cryptocurrencies, while investor Mark Cuban suggested that the SEC’s stance under Gensler could influence the upcoming presidential election.

- Gensler’s Response: Gensler avoided discussing election-related questions directly but reaffirmed that the SEC’s regulations regarding crypto securities are consistent and clear. He stressed that non-compliance with these regulations could harm the American public.

The SEC’s strict regulatory approach has faced criticism from various quarters:

- Compliance Issues: Gensler highlighted that many entities in the crypto space do not provide adequate disclosure, which he views as non-compliance with U.S. securities laws.

- Legal Repercussions: He pointed out that several prominent figures in the crypto industry are facing legal actions, ranging from jail sentences to extradition processes.

- Public Reactions: Ripple CEO Brad Garlinghouse openly criticized Gensler’s comments on an X post, accusing him of missing significant regulatory failures like those seen with FTX.

The potential approval of Ethereum ETFs represents a significant milestone for the cryptocurrency industry, indicating a growing acceptance of crypto assets within the regulated financial marketplace. This could lead to increased investments and broader institutional acceptance.

As the SEC navigates the complexities of integrating crypto assets into the regulated financial system, the outcome of the Ethereum ETF applications will likely have far-reaching implications for the market and regulatory frameworks. Stakeholders from across the financial and political spectrum are closely monitoring these developments, which could set precedents for future crypto-related products.