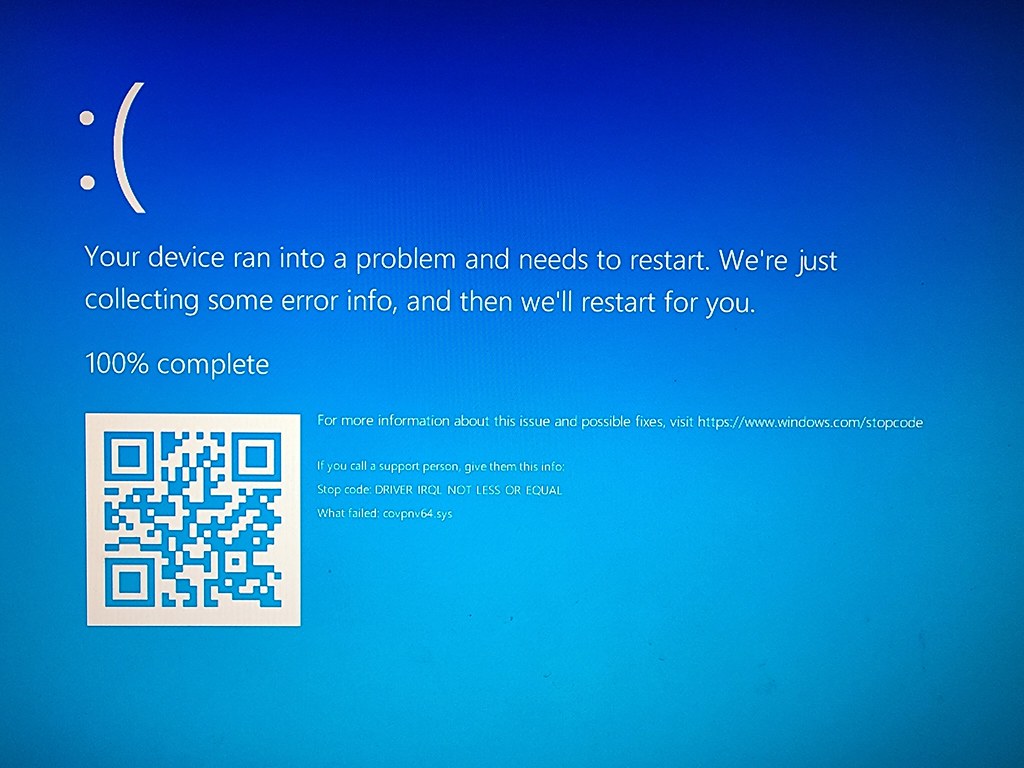

Cryptocurrency exchange Bybit has announced the integration of digital rupee payments into its platform. This development marks the inclusion of the Indian central bank digital currency (CBDC), aimed at enhancing the security and convenience for users making transactions in Indian rupees.

The introduction of the e-rupee on Bybit is expected to bolster security for users, offering a wallet-based payment solution. This new feature complements existing payment methods on Bybit, which include:

- Bank Transfers: Traditional payment through Indian banks.

- Third-Party Services: Payments via platforms like Paytm.

- Unified Payments Interface (UPI): The national payments portal managed by the Reserve Bank of India (RBI).

Bybit’s Dubai-based team emphasizes that using the digital rupee will help users reduce the risk of their bank accounts being targeted by cybercriminals. Joan Han, Bybit’s Sales and Marketing Director, commented:

“By incorporating the e-Rupee payment option, Bybit aims to elevate the payment experience for INR [Indian rupee] users, fostering trust and reliability in every transaction. Furthermore, this initiative is expected to attract a broader range of merchants to the platform.”

Currently, the digital rupee is utilized on Bybit for peer-to-peer cryptocurrency transactions. The Indian CBDC is part of a pilot project, with the retail e-rupee having been launched in December 2022, following the introduction of its wholesale version.

India-UAE CBDC Collaboration

In March 2023, the Reserve Bank of India (RBI) and the United Arab Emirates Central Bank signed a memorandum of understanding to establish a CBDC bridge between their jurisdictions. This collaboration highlights the growing importance and adoption of central bank digital currencies globally.

The presence of the digital rupee (or any CBDC) on a cryptocurrency exchange is a notable development. It reflects the evolving landscape of digital finance and the integration of traditional financial systems with emerging technologies.

Offline Capabilities and Programmability

Despite the digital rupee’s progress, there are ongoing efforts to enhance its usability, including plans to add offline capabilities. These improvements aim to increase the digital rupee’s accessibility in regions with limited internet connectivity.

Programmability was introduced to the digital rupee earlier this year. The first notable application of the programmable e-rupee occurred in April when IndusInd Bank used it to reimburse carbon credits to farmers. Despite these advancements, the wholesale e-rupee has faced criticism for being cumbersome and has seen limited use to date.

| Development | Details |

|---|---|

| New Payment Option | Integration of digital rupee (e-rupee) |

| Existing Payment Methods | Bank transfers, Paytm, UPI |

| Current Use on Bybit | Peer-to-peer crypto transactions |

| Retail e-Rupee Launch | December 2022 |

| Wholesale e-Rupee Launch | Prior to retail launch |

| India-UAE CBDC Bridge | MoU signed in March 2023 |

| First Programmable e-Rupee Use | Reimbursement of carbon credits in April |

| Criticism | Wholesale e-rupee criticized as cumbersome |

Bybit’s addition of the e-rupee payment option represents a significant step in integrating central bank digital currencies with cryptocurrency exchanges, potentially paving the way for wider adoption and enhanced security in digital transactions.