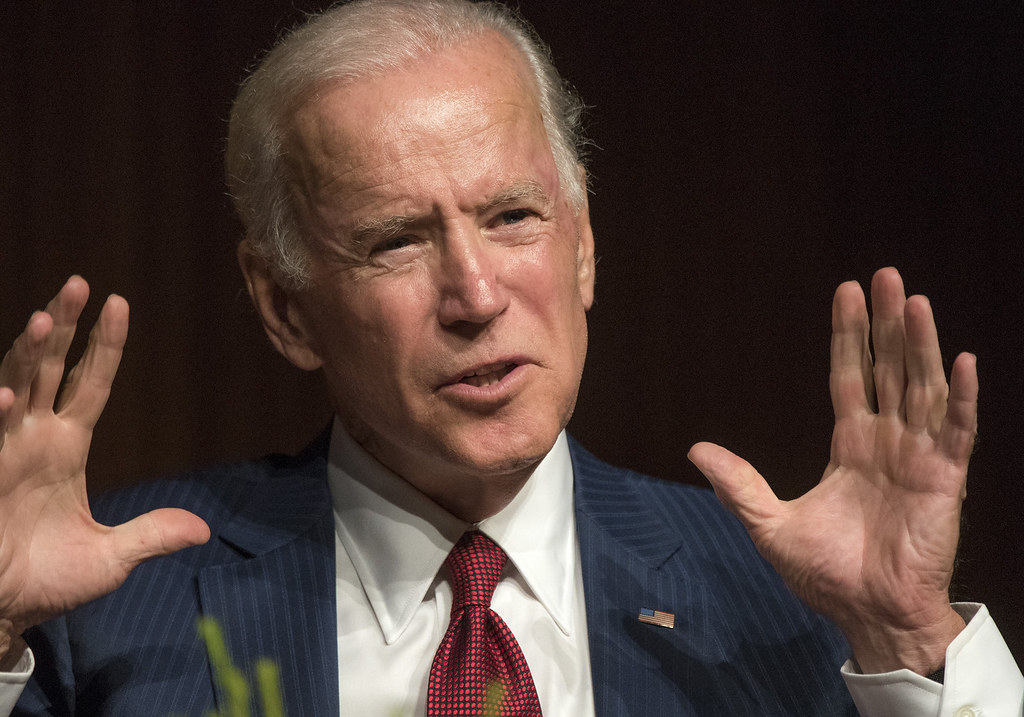

The recent announcement by U.S. President Joe Biden that he will not seek re-election in the 2024 Presidential race had an immediate, albeit brief, impact on Bitcoin’s market value. This development brought both volatility and a short-term recovery in Bitcoin’s price, highlighting the sensitivity of cryptocurrency markets to political changes.

Timeline of Events

- July 21: President Joe Biden announces his exit from the 2024 presidential race.

- Immediate Market Reaction: Bitcoin experiences an initial drop but quickly recovers.

- Price Recovery: Bitcoin’s price climbs nearly 1.5% within the same day, reaching a one-month high of $68,364.

Post-Announcement

Initially, Bitcoin’s price fell by 3% following Biden’s announcement, driven by the uncertainty this news introduced into the market. However, analysts from Bitfinex noted that the cryptocurrency soon recovered, citing this as a “knee-jerk reaction” to the sudden news. By the following Monday morning, Bitcoin had increased by 0.9% over the previous 24 hours, approaching its near all-time high of $73,666 achieved in March.

The departure of President Biden introduces a phase of uncertainty concerning future U.S. policy directions, particularly concerning the regulation of digital assets. This uncertainty is viewed by analysts as “neutral to slightly negative in the short term,” given the unpredictability of potential policy shifts under new leadership.

Vice President Kamala Harris’s

On July 23, Vice President Kamala Harris secured the necessary delegate support to clinch the Democratic Party’s presidential nomination. However, her stance on cryptocurrencies remains largely undefined, which poses a potential wildcard for the crypto industry. Her known focus on consumer protection and financial regulation suggests that she may continue or even intensify scrutiny of the crypto market.

Given the current ambiguities, crypto investors are likely to adopt a more cautious, wait-and-see approach until clearer policy directions emerge from Harris’s campaign. This sentiment is influenced by the existing administration’s cautious stance on cryptocurrency, emphasizing regulation.

Billionaire investor Mark Cuban suggests that Harris might be more open to technological innovation and cryptocurrencies than Biden, which could eventually influence the regulatory landscape positively. However, until such policies are articulated, the market remains in a state of watchful anticipation.

Despite the unfolding events, prediction markets like Polymarket show a strong favoritism towards former President Donald Trump, with over 62% betting on his win in the upcoming November elections, compared to 35% for Harris.

| Date | Event | Immediate Impact on Bitcoin Price |

|---|---|---|

| July 21 | Biden exits 2024 race | 3% drop, then 1.5% recovery to $68,364 |

| July 23 | Harris secures Democratic nomination | No significant immediate impact on price |

| Ongoing | Market analysis | Cautious investor approach pending policy clarity |

The interplay between U.S. presidential politics and cryptocurrency market dynamics illustrates the broader impacts of geopolitical events on digital assets. As the political landscape ahead of the 2024 U.S. Presidential Election continues to evolve, the cryptocurrency market remains particularly attuned to potential regulatory changes that could arise from new leadership.