Amidst evolving economic landscapes and political discourses, the conversation around Bitcoin’s integration into national treasury systems has gained significant momentum. Recently, asset manager Bryan Courchesne appeared on CNBC to discuss the intriguing potential of Bitcoin becoming a strategic reserve asset for the United States under a prospective Trump administration.

The Feasibility of Bitcoin as a Reserve Asset

Courchesne outlined the complex yet feasible path for Bitcoin to be adopted as a reserve asset by the U.S. government. He noted the significant holdings of Bitcoin by the Department of Justice, estimated at around 200,000 BTC, positioning the U.S. government as one of the largest holders globally, second only to Bitcoin’s enigmatic creator, Satoshi Nakamoto.

- Strategic Transfer to the Treasury: Courchesne proposed that these Bitcoin assets could be transferred from the Department of Justice to the Department of the Treasury. This move would set a foundational precedent for the Treasury to start accumulating Bitcoin as a long-term strategic asset.

Global Reserve Asset Potential

The discussion extends beyond national borders, considering Bitcoin’s potential role as a global reserve asset. This scenario gains traction considering the backdrop of increasing global debt and monetary inflation, which has escalated interest in more decentralized and stable value stores like Bitcoin.

- Inflation and Geopolitical Instability: Observations from high-inflation countries such as Argentina, Venezuela, and Turkey illustrate a growing reliance on cryptocurrencies as a hedge against economic instability. This grassroots adoption could lay the groundwork for Bitcoin’s elevation to a global reserve status.

The speculation about Bitcoin’s future in U.S. financial strategy is further amplified by political developments. Former President Donald Trump’s supportive stance on digital assets and his selection of JD Vance, a known Bitcoin advocate, as his running mate, suggest a potential policy shift towards greater integration of crypto in the financial system.

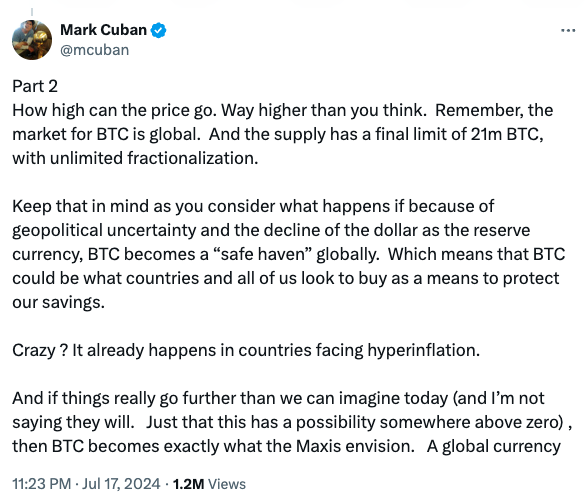

- Mark Cuban’s Perspective: Billionaire investor Mark Cuban speculated that widespread inflation and geopolitical issues might push global populations towards Bitcoin, seeking it as a refuge to safeguard assets.

Skepticism and Realistic Assessments

Despite the optimistic views, there are skeptics like Ari Paul, founder of BlockTower Capital, who caution against overestimating Bitcoin’s immediate adoption as a strategic reserve. Paul argues that the likelihood of Bitcoin being designated as part of the U.S. strategic reserves in the near term remains low, citing a 10:1 ratio against such a development within the next four years.

- Challenges and Considerations: The concept of a strategic reserve is traditionally reserved for assets critical in national emergencies. Paul emphasized that even if a future president refrains from selling off U.S. Bitcoin holdings, formal recognition as a strategic reserve might still not be forthcoming.

As the dialogue around Bitcoin’s role in national and global financial systems evolves, it becomes clear that both opportunities and challenges lie ahead. The integration of Bitcoin as a reserve asset would not only redefine its market dynamics but also signal a significant shift in monetary policy and economic strategy.

- Looking Ahead: The coming years will be crucial in determining whether Bitcoin can transcend its current speculative and investment phases to become a cornerstone of financial stability and government policy.

| Topic | Details |

|---|---|

| U.S. Government’s Bitcoin Holdings | Approx. 200,000 BTC, potential transfer to the Treasury |

| Global Adoption Trends | Increased use in high-inflation countries as a financial safeguard |

| Political Influence | Trump’s pro-crypto stance and implications for policy |

| Market Speculations | Cuban and Paul’s differing views on Bitcoin’s future role |