Europe’s ambition to establish a robust electric vehicle (EV) battery industry remains alive, though increasingly tied to Chinese partnerships. Following the financial downfall of Swedish startup Northvolt, European battery initiatives are turning to Chinese expertise and funding to sustain momentum.

Slovakian startup InoBat exemplifies this trend. Last year, China’s fifth-largest battery maker, Gotion, acquired a 25% stake in the company and entered a joint venture to build gigafactories across Europe. This collaboration was further solidified on Friday when InoBat announced €100 million ($104 million) in Series C funding, pushing its total raised to over €400 million.

The funding demonstrates continued investor interest in European EV battery projects despite recent setbacks. However, reliance on Chinese partnerships, such as the Gotion-InoBat Batteries (GIB) joint venture, points to a future dominated by collaborative models rather than independent European production.

China’s Low-Cost Advantage Fuels European Partnerships

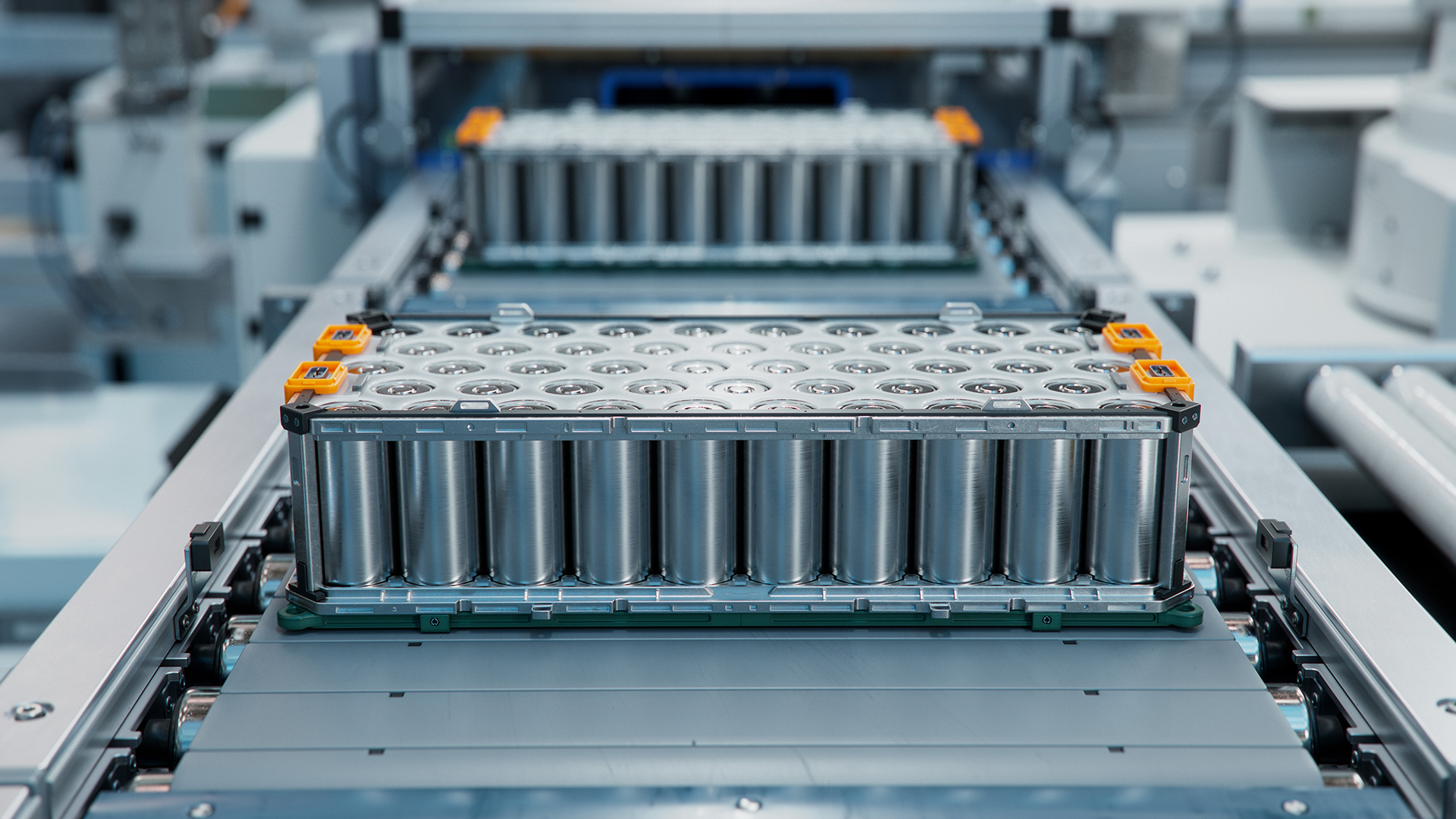

Industry analysts highlight the financial and technical advantages Chinese companies bring to the table. Hefei-based Gotion, for example, had a nominal battery capacity of 150 gigawatt hours (GWh) in 2023, sufficient to power up to two million vehicles. This capacity is projected to surge to 270 GWh by 2025, dwarfing Europe’s current production capabilities.

InoBat CEO Marian Bocek acknowledged Gotion’s critical role in accelerating his company’s projects. “This helps us move faster and conserve cash,” Bocek explained. Gotion’s backing not only enables the construction of a $1.2 billion gigafactory in Surany, Slovakia, but also reassures automakers wary of financial risks. The factory aims to supply batteries for 200,000 EVs annually by 2027, with Volkswagen—holding a 24.45% stake in Gotion—among the key customers.

Challenges Persist Amid Growing Chinese Influence

Despite promising developments, Europe’s EV battery ambitions face persistent challenges. High-profile failures, including Northvolt and Britishvolt, have cast doubt on the viability of standalone European startups. Automakers increasingly demand proven scalability, further pressuring new entrants to secure reliable production partners.

Even established players like France’s Verkor and Britain’s Ilika navigate cautious markets. Verkor has secured €3 billion for its 16 GWh gigafactory in Dunkirk but must prove its delivery capabilities before automakers commit to large-scale orders. Similarly, Ilika is opting for licensing agreements to mass-produce its solid-state batteries rather than building its own gigafactory.

Industry experts emphasize that collaboration with Asian manufacturers may be inevitable. “The Chinese have mastered low-cost mass production,” noted Andy Leyland, co-founder of SC Insights. “If you want batteries made, most likely Asian battery makers will make them.”

A Collaborative Future for Europe’s EV Batteries

While the dream of an independent European EV battery industry dims, projects like the Gotion-InoBat partnership offer a pragmatic path forward. As Europe’s fourth-largest car producer, Slovakia provides a strategic base for high-volume production near key automotive markets in Germany, the Czech Republic, and Hungary.

InoBat also aims to carve out a niche with high-performance, energy-dense batteries for luxury automakers like Ferrari, leveraging its low-volume, high-margin production capabilities in Voderady. Meanwhile, government aid, such as Slovakia’s €214 million contribution to the Surany gigafactory, highlights the role of public funding in sustaining these projects.

The evolving landscape suggests a hybrid model where European innovation meets Chinese manufacturing prowess, enabling progress despite market uncertainties.