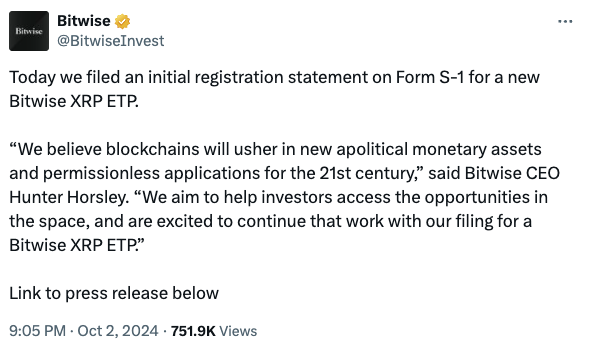

Cryptocurrency asset manager Bitwise has officially submitted a Form S-1 filing for the first spot XRP exchange-traded fund (ETF) with the United States Securities and Exchange Commission (SEC). This move marks a significant step for the firm as it seeks to provide investors with access to the value of XRP through a regulated investment vehicle.

The proposed Bitwise XRP ETF aims to offer exposure to the value of XRP held by the trust, “less the expenses of the trust’s operations and other liabilities,” according to the filing. This structure is designed to provide a straightforward way for investors to gain exposure to XRP without needing to hold the cryptocurrency directly.

Bitwise’s Vision for Blockchain Assets

In a press release announcing the filing on October 2, Bitwise CEO Hunter Horsley articulated the firm’s belief in the transformative potential of blockchain technology:

“At Bitwise, we believe blockchains will usher in new, apolitical monetary assets and permissionless applications for the 21st century. It’s why for the past seven years we’ve helped investors access the opportunities in the space, and we’re excited to continue that work with our filing for a Bitwise XRP ETP.”

This statement underscores Bitwise’s commitment to facilitating access to the evolving cryptocurrency landscape for investors.

In the filing, Bitwise specified that the trust’s XRP holdings would be stored with Coinbase Custody Trust Company, consistent with the custodianship arrangements for its other crypto ETFs. The filing notes:

“The XRP custodian is not insured by the Federal Deposit Insurance Corporation but carries insurance provided by private insurance carriers.”

Bitwise also indicated that the XRP ETF would utilize the cash-create method for creating and redeeming shares, with plans to notify shareholders if the trust obtains the necessary regulatory approvals for in-kind creations and redemptions.

This operational structure aims to enhance liquidity and facilitate more efficient trading for ETF investors.

Recent Developments and Strategic Moves

The filing for the XRP ETF follows Bitwise’s earlier submission for an XRP ETF Trust in Delaware on October 2, signaling a coordinated effort to position the firm at the forefront of the evolving ETF landscape.

Before pursuing the XRP ETF, Bitwise was recognized as one of the first issuers to launch a spot Bitcoin ETF in January. The firm also participated in the trading of spot Ether ETFs, which began in July. However, as of this writing, Bitwise has not filed for a spot Solana ETF, despite other issuers like VanEck making such filings.

Nate Geraci, president of the ETF Store, an investment advisory firm specializing in ETFs, shared his thoughts on the significance of the spot XRP ETF filing, labeling it “highly noteworthy.” He suggested that the filing could be seen as a strategic move in light of the upcoming “November election.” However, Geraci clarified that Bitwise’s approach is methodical, stating:

“That’s simply not in their DNA. This is strategic.”

In related news, journalist Eleanor Terrett informed her followers on X that Canary Capital, a crypto-focused investment firm, had incorporated an XRP ETF with the Delaware Division of Corporations on September 24. Terrett noted that the firm was co-founded by the former chief investment officer of asset management firm Valkyrie.

Ripple’s License Approval in Dubai

In a separate yet related development, Ripple, the blockchain technology company behind XRP, announced on October 1 that it received in-principle license approval from the Dubai Financial Services Authority (DFSA). This license allows Ripple to establish a presence in the region and, once fully approved, will enable the firm to offer cross-border payment services for fiat and digital assets within the Dubai International Financial Center (DIFC) in the United Arab Emirates.

To finalize the licensing process, companies in the DIFC, including crypto-related entities, must fulfill several prerequisites before they can be issued a full license in the UAE. This regulatory framework aims to foster a secure and compliant environment for cryptocurrency and blockchain businesses operating in the region.

Bitwise’s filing for the first spot XRP ETF with the US SEC represents a significant milestone in the cryptocurrency investment landscape. As institutional interest in digital assets continues to grow, the ability to access regulated investment vehicles like ETFs becomes increasingly important for both retail and institutional investors.

The coordinated efforts of firms like Bitwise, along with regulatory developments such as Ripple’s license approval in Dubai, highlight the evolving dynamics of the cryptocurrency market. As the landscape continues to change, stakeholders will need to adapt to new opportunities and challenges while ensuring compliance with regulatory standards.

| Key Details of the Bitwise XRP ETF | Information |

|---|---|

| ETF Filing Date | October 2 |

| Purpose of ETF | Provide exposure to XRP value |

| Custodian for XRP Holdings | Coinbase Custody Trust Company |

| Total Investment in Bitcoin ETF | $60,289.81 (Bitcoin price at the time of writing) |

| CEO of Bitwise | Hunter Horsley |

| Previous ETF Launches | Spot Bitcoin ETF in January; Spot Ether ETFs in July |

| Strategic Focus | Access to apolitical monetary assets |